Singapore’s 15-Month Wait-Out Rule May Be Reviewed — What It Means for the Property Market

- kiapkaysan

- May 29, 2025

- 3 min read

A potential review of the 15-month wait-out rule for private property owners looking to buy HDB resale flats is generating buzz in Singapore’s property sector. Introduced in September 2022, the rule was part of a broader effort to cool an overheated resale market. With signs pointing to a stabilisation in the HDB resale segment, the government is reportedly considering easing this measure — and that could bring a wave of both opportunity and caution to the market.

⸻

What is the 15-Month Wait-Out Rule?

The rule mandates that private property owners, including former private homeowners, must wait 15 months after selling their property before they can purchase a non-subsidised HDB resale flat. This cooling measure was implemented to prioritise public housing for first-time buyers and reduce competition from more affluent buyers who could otherwise outbid genuine HDB upgraders or young families.

⸻

Why a Review Might Be Coming

Since the rule was enforced, Singapore’s HDB resale market has shown signs of moderation:

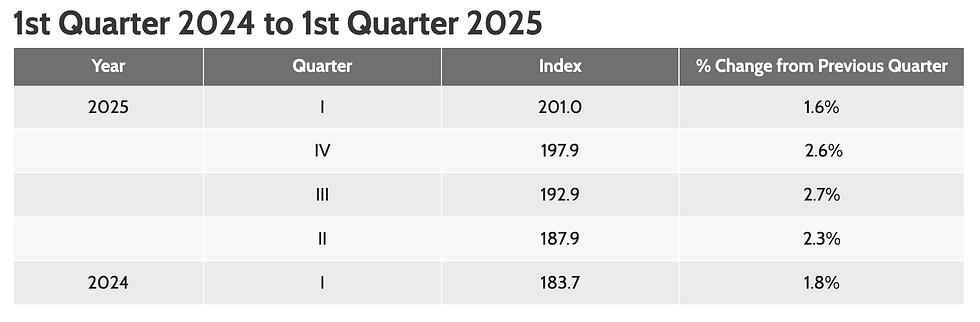

• Slower Price Growth: Resale price increases have cooled from the record-breaking jumps seen in 2021 and early 2022.

According to Business Times, resale prices over the past 3 months was observed to be lower than fourth quarter of last year. The growth has also marked the slowest increase of 1.6 percent as compared to average quarter growth of 2.3 percent in 2024

• Fewer Million-Dollar Deals: The volume of high-value resale transactions has tapered.

• Supply Catch-Up: New BTO launches and completion of delayed projects are helping ease demand pressure on the resale market. With new BTO launches meeting the target of 100,000 flats from 2021 to 2025, and HDB has successfully completed 75,800 flats as of 8 Mar in these new projects, these contributed to the increased housing supply.

These trends suggest the market has reached a more balanced state. Thus, the rationale behind the 15-month rule may no longer be as urgent, prompting the government to consider reviewing the measure.

⸻

Pros of Lifting or Easing the Rule

1. Eases Right-Sizing for Seniors and Empty Nesters

Many older Singaporeans living in private properties may wish to move to smaller HDB units for retirement, lifestyle, or financial reasons. The wait-out period creates unnecessary hardship for those who don’t qualify for exemptions. Lifting the rule could offer these groups much-needed flexibility.

2. Stimulates HDB Resale Demand (In a Healthy Way)

With the market now more stable, allowing a return of private home downgraders could inject fresh demand into the HDB resale segment without causing overheating. This may be especially beneficial for sellers of larger or more mature flats, where demand has been softening.

3. Improves Market Fluidity

Property markets thrive on transaction flow. By removing artificial restrictions, buyers and sellers can act more freely, resulting in a more efficient and responsive housing ecosystem.

4. Positive Sentiment for the Broader Property Market

A review sends a strong signal of government confidence in market conditions. That could improve investor and homeowner sentiment across the board — from public to private housing.

⸻

Cons and Risks of Relaxing the Rule

1. Resale Flat Prices May Spike Again

Even a modest return of private buyers could reignite competition in popular HDB towns, potentially pushing prices back up — especially in mature estates where demand is already resilient.

2. First-Time Buyers Could Be Squeezed

The original intent of the rule was to give first-timers better access to resale flats. A premature rollback may unintentionally disadvantage young families or lower-income Singaporeans, once again pricing them out.

3. Potential Misalignment with Broader Affordability Goals

Singapore has worked hard to maintain a stable, affordable public housing system. If the market rebounds too quickly after easing restrictions, it could undermine years of cooling efforts and hurt public perception of fairness.

4. Timing May Be Critical

If the rule is lifted too soon, especially before the supply from new BTO projects fully meets demand, we could see a short-term spike in resale activity that reverses recent stabilisation trends.

⸻

Conclusion: A Balancing Act Ahead

The possible review of the 15-month wait-out rule marks an important moment for Singapore’s housing market. While its removal could create greater flexibility for older homeowners and support a more fluid property market, it must be done carefully to avoid undermining affordability and access for genuine first-time buyers.

As with many of Singapore’s housing policies, the success of any change lies in striking a balance — between encouraging market activity and maintaining housing as a social good. If the government proceeds with a review, it will likely be measured, possibly with targeted exemptions or phased rollbacks.

For now, the market will be watching closely. Any official announcement could reshape both short-term buying behaviour and long-term housing trends across the island.

Comments