The Ultimate Guide for First-Time Property Buyers: What to Look Out For

- kiapkaysan

- May 23, 2025

- 3 min read

Updated: May 27, 2025

Buying your first home is an exciting life milestone—but it can also be a maze of information, jargon, and big decisions. Without proper guidance, first-time buyers may face unexpected costs, poor resale prospects, or lifestyle compromises.

To help you make a confident and informed purchase, we’ve put together a comprehensive guide that walks you through key considerations and common pitfalls.

1. Get Financially Prepared – Know Your Numbers

Before browsing listings or visiting showflats, take a long, honest look at your financial situation.

Key Things to Prepare:

Total budget (not just purchase price): factor in down payment, stamp duties, legal fees, agent fees, renovation, and furniture.

Loan eligibility: Get a mortgage pre-approval or In-Principle Approval (IPA) from the bank. This shows sellers you're a serious buyer.

Monthly commitment: Ensure your mortgage payment, together with other debts, stays within your Total Debt Servicing Ratio (TDSR) limit.

Common Pitfall:

Many first-timers overestimate what they can afford, max out their home loan, and leave no room for emergencies or rising interest rates.

2. Know Your Purpose – Home vs Investment

Buying for your own stay differs greatly from buying as an investor.

If Buying to Live In:

Prioritise layout, comfort, accessibility, lifestyle needs, and future family plans.

Consider commute times, school proximity, and amenities.

If Buying for Investment:

Focus on rental yield, tenant demand, upcoming infrastructure, and future resale value.

Look into supply-demand dynamics in the area.

Common Pitfall:

Letting emotion drive decisions, like falling in love with a showflat or following a trend, without considering long-term suitability.

3. Location, Location, Location

Location affects everything—your convenience, quality of life, and the property's future value.

Factors to Consider:

Proximity to MRT, buses, and expressways

Nearby schools, shops, parks, and healthcare

Upcoming developments that might enhance (or disrupt) the neighborhood

URA Master Plan: see what’s planned in the area

Common Pitfall:

Choosing a cheaper property in a remote location, then facing long commutes, poor rental demand, or slow appreciation.

4. Freehold vs Leasehold – What’s the Difference?

Freehold:

You own it forever

Generally higher price and prestige

Better for long-term holding or legacy planning

Leasehold (e.g. 99 years):

Cheaper upfront

May depreciate faster after 30–40 years

Financing and resale can be tricky with shorter leases

Common Pitfall:

Ignoring the lease tenure and buying an older leasehold unit without understanding its long-term implications.

5. Inspect the Property Carefully

For resale units, always conduct a thorough physical inspection:

What to Check:

Cracks in walls or ceilings

Signs of leaks or water damage

Flooring condition

Mold, especially in bathrooms and kitchens

Aircon units, electrical points, built-in cabinets

For New Launches:

Visit showflats with a critical eye. Most decor, furnishings, and fittings shown are not included in the actual unit.

Common Pitfall:

Assuming everything in the showflat is included or not budgeting for major renovation works in resale units.

6. Legal and Regulatory Considerations

Every property purchase must go through proper legal checks to ensure your rights and eligibility.

Key Things to Verify:

Property ownership and title deed

HDB eligibility (income ceiling, ethnic quota, citizenship)

CPF housing grants (for first-time buyers)

Option to Purchase (OTP) and Sales & Purchase Agreement (SPA) terms

Common Pitfall:

Not checking restrictions or eligibility for government grants, or missing crucial clauses in contracts.

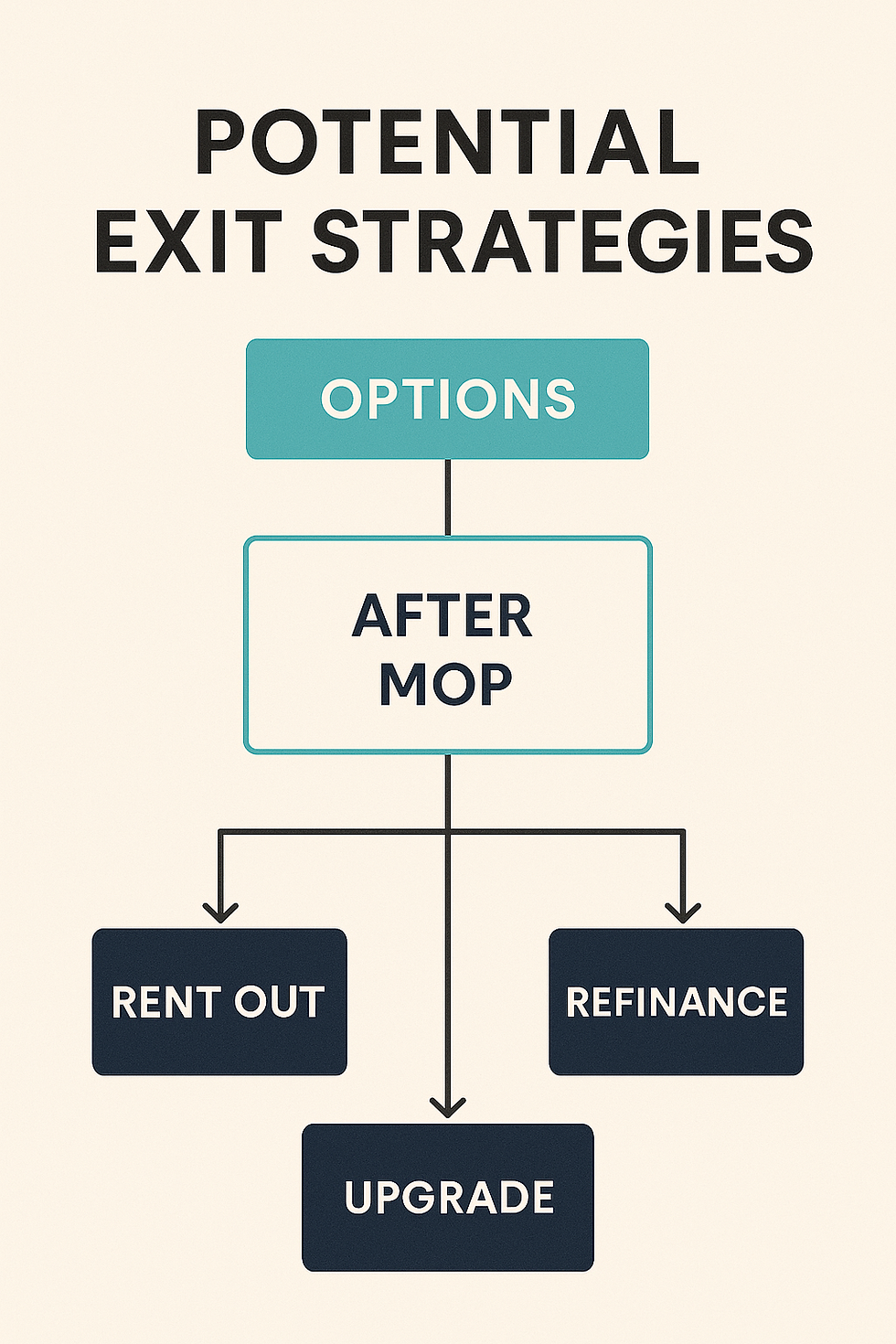

7. Have an Exit Plan – Think Beyond the First 5 Years

Even if you’re buying a forever home, it’s smart to think ahead.

Key Questions:

Will the unit be easy to sell or rent out in the future?

What are the growth prospects in the area?

What are the cooling measures that may affect timing (e.g., Seller’s Stamp Duty)?

Will lifestyle changes (e.g. job, kids) make the property unsuitable?

Common Pitfall:

Not planning for changes in life or market cycles, leading to difficulties selling or upgrading later.

8. Don’t Let Emotions Drive the Purchase

Home-buying is emotional, but decisions should be logical.

Tips to Stay Objective:

Make a “Needs vs Wants” list and stick to it

Visit multiple properties for comparison

Sleep on big decisions—don’t rush just because others are buying

Common Pitfall:

Falling in love with a unit or being pressured during a sales launch and ignoring red flags.

Final Thoughts: Be Informed, Be Confident

Buying your first property is not just about choosing a place to live—it’s one of the most important financial decisions you'll make. Take your time to understand your options, consult professionals, and prepare both financially and emotionally.

Need help navigating the process or want tailored advice?

Contact me here to schedule a consultation or view curated listings that fit your goals.

Comments